Key performance indicators for business valuation

Gross profit margin and business valuation

The larger the gross profit margin ("GP%") the more breathing space the business appears to have. Margin space can be used for attracting customers with discounts, or retaining customers with easier terms. High GPs make the break-even point of sale easier to reach in each period.

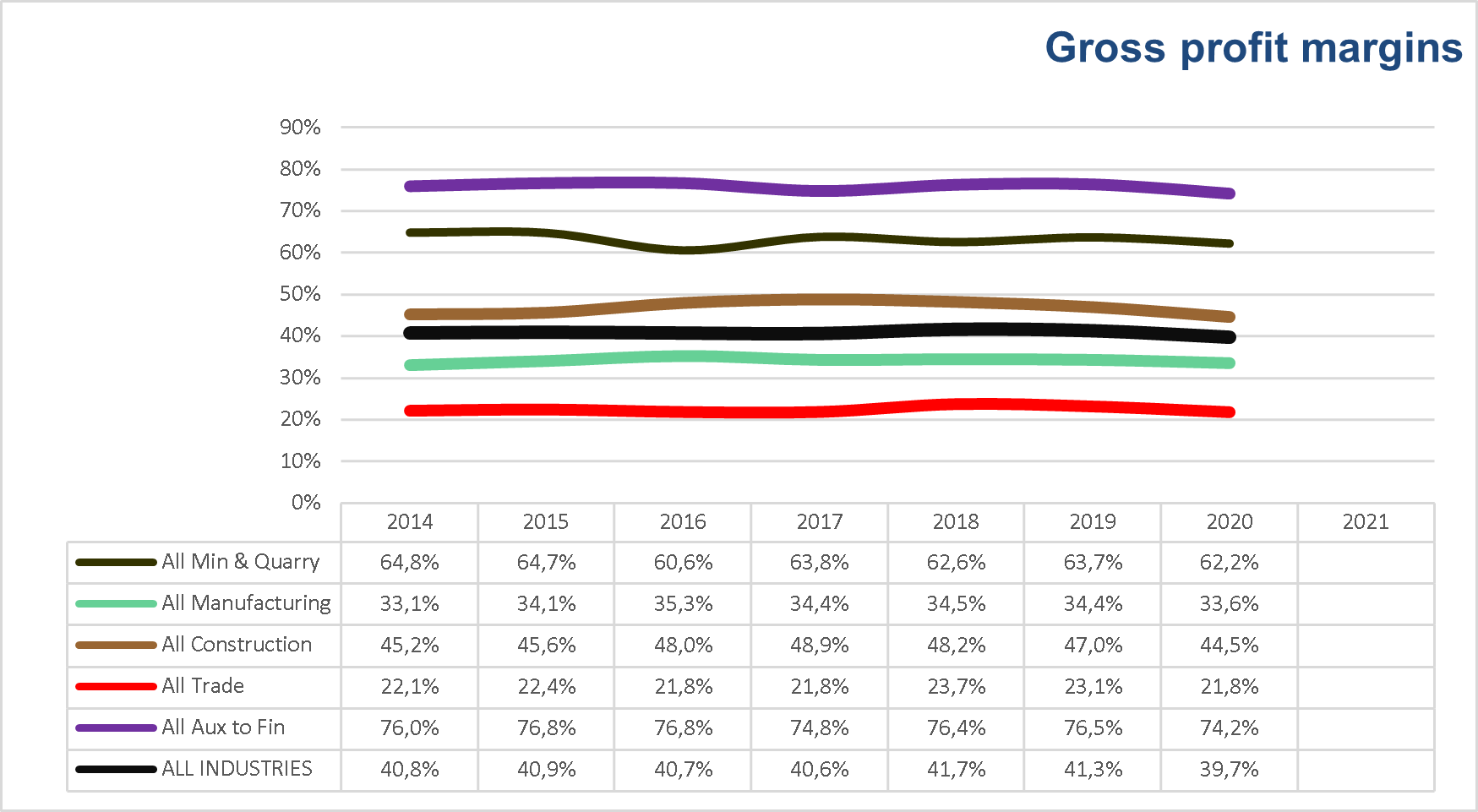

In South Africa, the gross profit across the board of all industries is usually around 41%. In 2020 that proportion dropped to 39.7%, the lowest in years. (We have figures going back to 2014, and the lowest we have previously seen is 40.6% in 2017.

How does your business compare? How did it compare in previous years?

Let's fine-tune the KPIs within industries

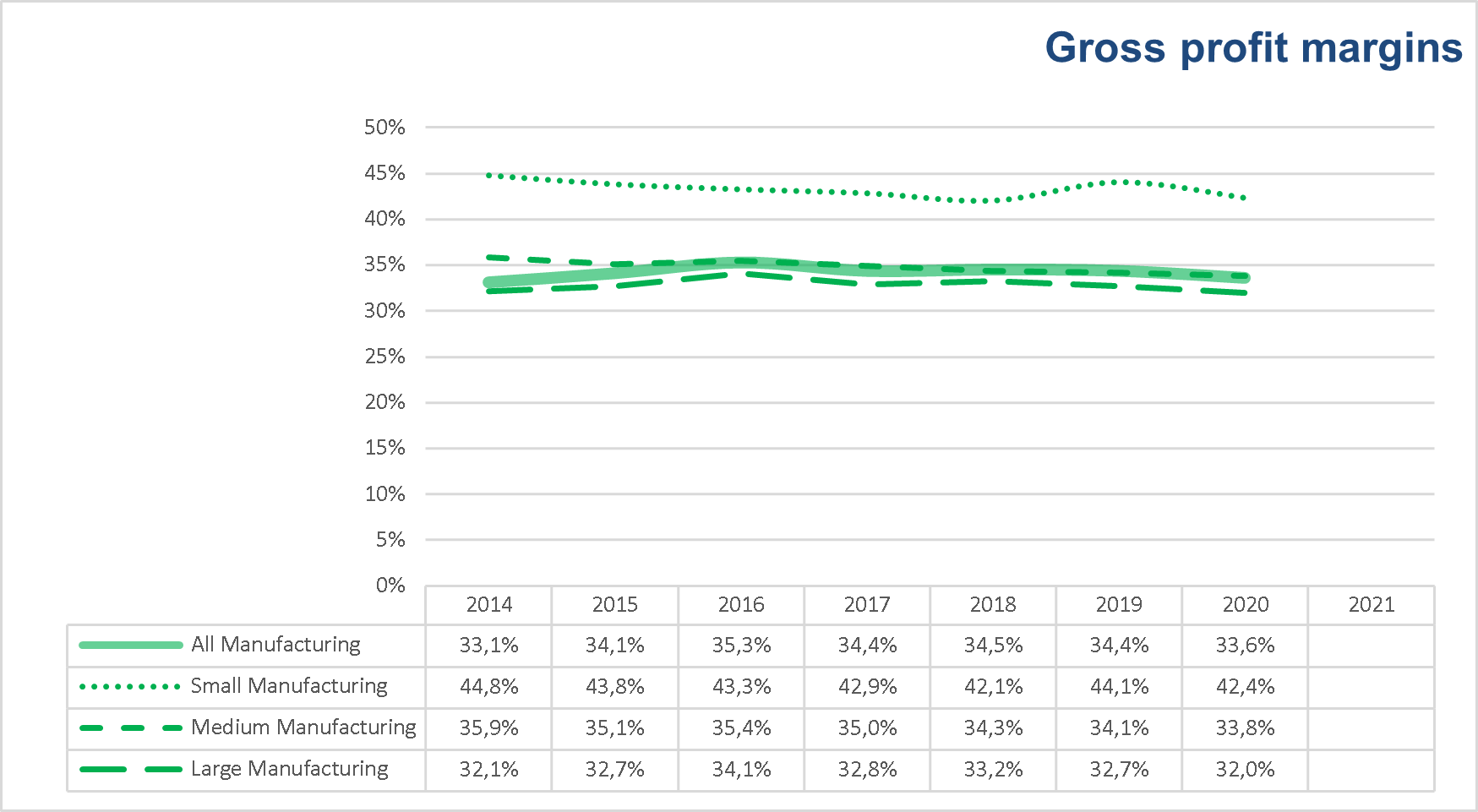

StatsSA discriminates between business of different sizes, within each industry, by turnover. So for instance, the manufacturing industry has the following size differentials:

Anything up to R97,5 million annual turnover is "small" and "large" clicks in at R382,5 million. Between those boundaries is "medium".

Both medium and large manufacturing, and the industry as a whole is lower than the GP% for all industries in South Africa. But small industries enjoy a significantly higher gross margin.

Key performance indicators in trade business valuations

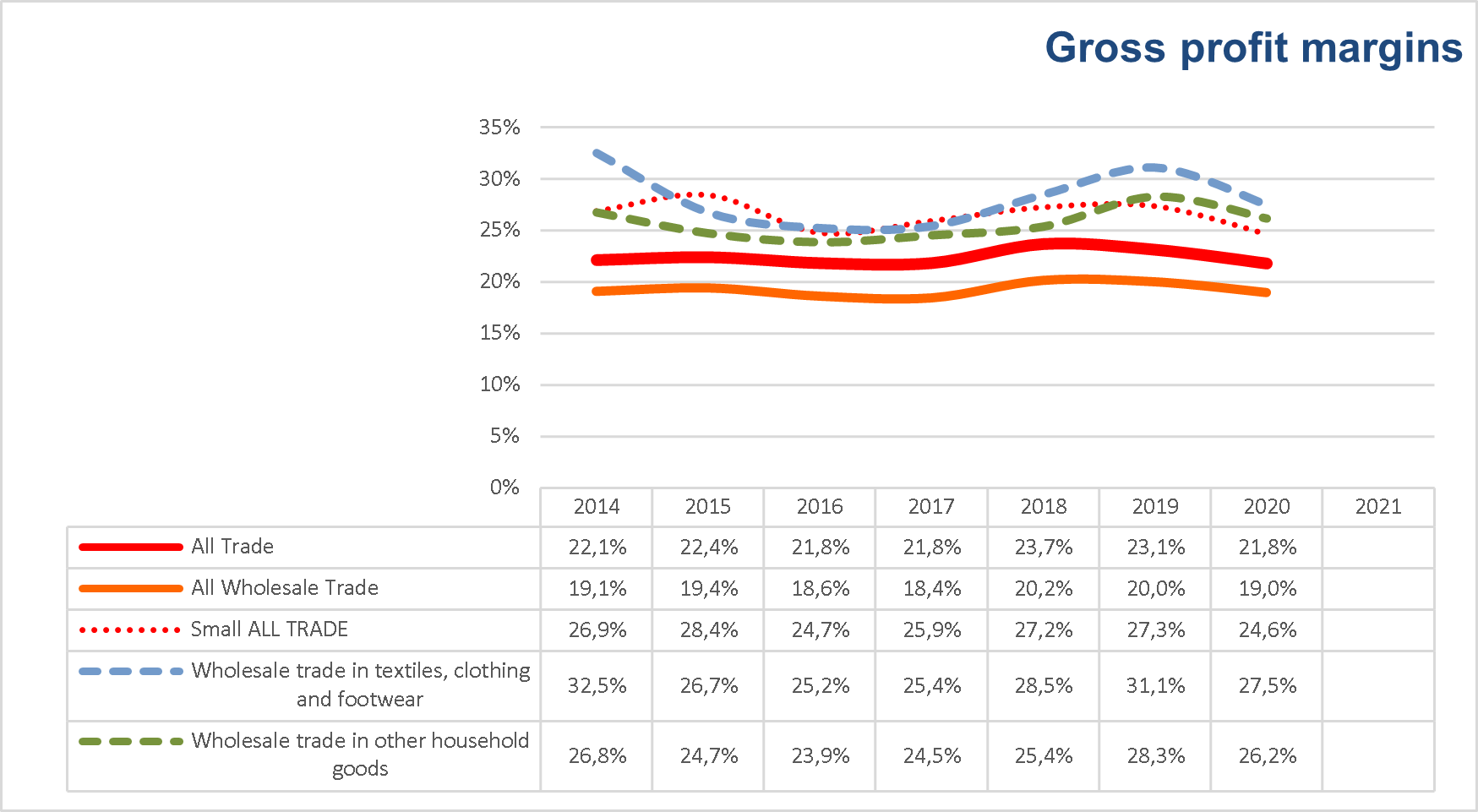

"The trades" are broken down by size as well. But also by sub-categories: Wholesale and retail trades, motor trades, and hospitality trades. Within each of these sub-categories, there are different sizes which may or may not correlate in size. That is because a medium size hospitality trade business is between R45 million turnover and R97,5 million. A small wholesale trade business is anything up to R240 million, and they only get to be recognised as "large" when their turnover exceeds R480 million.

The trade industries show up as an average GP of about 22% because they are dragged up by the hospitality trade in the 60%s.

The hospitality trade sub-category refers to a broad range of hotels to guest-houses, and camp-sites. Also included: premium grade restaurants to fast food franchise outlets and event - trailer take-aways. Pubs, bars, soup-kitchens all fit into this group.

The sub-category does not include wholesale suppliers to the members of this group. And although they are all essentially retail outlets, they are excluded from the retail trade grouping.

What they don't differentiate is the size difference within the sub-categories. For that, all the trades are lumped together.

Trade | Small | Medium | Large |

|---|---|---|---|

Wholesale | ≤ R240,0 M | > R240,0 M ≤ R480,0 M | > R480,0 M |

Retail and motor | ≤ R142,5 M | > R142,5 M ≤ R292,5 M | > R292,5 M |

Hospitality | ≤ R45,0 m | > R45,0 M ≤ R97,5 M | > R97,5 m |

So how will you compare your business to something more specific than simply the "wholesale trade" or all "small trade"?

We have calculated the GP%s for 350 specific standard industry codes ("SIC"), each for the last seven years.

We make that available as part of every business valuation we do. Actually, it is required information we have on file for every business valuation we do.

Of course a simple comparison to known gross margins is just the start of the business valuation exercise. We compare each business to its industry, subcategory, size, and SIC for all the usual key performance indicators, plus a bunch of valuation-specific metrics. We can call on more than 20 different performance, liquidity, structural, and predictive metrics.

Together, they constitute one key valuation indicator ("KVI") of each business. We have developed an analysis for 23 KVIs to make our valuation findings defendable and truly independent.

We conduct considered, bespoke, reasoned

Business Valuations

specific to South African companies of all sizes in all industries